eCommerce: Amazon’s 3P vs. 1P Evolution – Which Path Will It Take?

eCommerce: Amazon’s 3P vs. 1P Evolution – Which Path Will It Take?

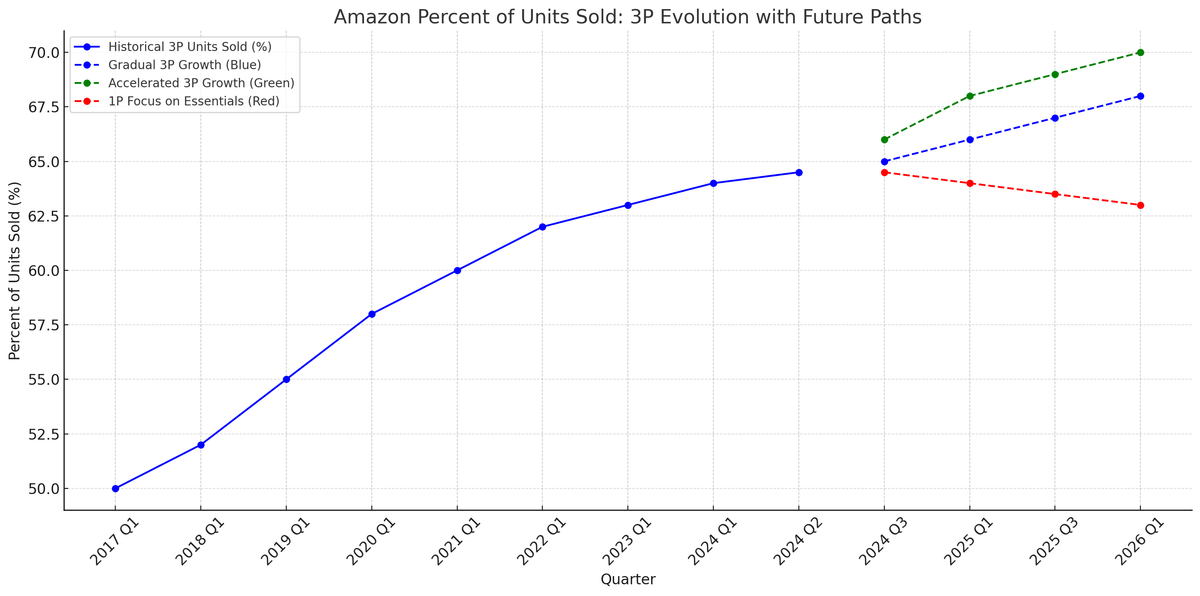

Amazon’s marketplace strategy has been a hot topic for years, with the company constantly balancing its dual focus on profitability and seller support. The evolution of Amazon’s third-party (3P) and first-party (1P) models is at the center of this strategy, and the future of this balance is more critical than ever.

The Core Question: What’s Next for Amazon?

Will Amazon continue to gradually expand its 3P marketplace, accelerate with a significant 1P vendor reduction, or double down on its Q3 strategy focusing on essentials and low-priced 1P items?

Key Highlights and Trends

- Third-Party Sellers on the Rise: Amazon’s 3P marketplace has grown steadily, with more than 60% of units sold on Amazon now coming from third-party sellers. This is a significant shift from below 50% in 2017. The steady increase highlights Amazon’s focus on diversifying its revenue streams while enabling small and medium-sized businesses (SMBs) to reach wider audiences.

- $27 Billion in Fees: In the last reported quarter, third-party sellers contributed a staggering $27 billion in fees to Amazon. This underscores the lucrative nature of the 3P model for Amazon, as it allows the platform to benefit from high-margin service fees without the overhead associated with holding inventory.

- Amazon’s Net Income Boom: In Q3, Amazon’s net income surged to $15.3 billion, showcasing its ability to balance profitability with investment. This financial health supports Amazon’s continued exploration of its marketplace strategy.

- Dominance in U.S. E-commerce: Amazon captures over 40% of all U.S. e-commerce sales. This dominant position means that shifts in its marketplace approach can ripple across the entire retail landscape.

- Growing Logistics Power: The company has seen a 25%+ increase in same-day delivery customers. This logistics capability could support both its 3P sellers and 1P essentials strategy, providing consumers with faster, more reliable shipping options.

The Possible Paths Forward

1. Gradual Shift Toward a 3P Marketplace (Blue)

The steady growth of third-party sellers suggests that Amazon could continue along this trajectory. Benefits include higher margins from fees, reduced inventory risk, and an expanded selection for consumers. For brands, this presents an opportunity to engage directly with customers while leveraging Amazon’s massive reach.

Implication for Brands: Brands should evaluate their readiness to transition to a 3P model, especially if they are looking for more control over pricing, branding, and customer interaction.

2. 1P Vendor Purge (Green)

Amazon has previously made headlines with sudden purges of its 1P vendor base. If Amazon accelerates this approach, it would mean focusing its internal resources on high-margin, low-inventory-risk items and shifting more responsibility to 3P sellers.

Implication for Brands: Brands that heavily rely on Amazon’s 1P distribution should closely monitor for signs of vendor reductions and develop contingency plans to maintain their market presence.

3. Focus on Essentials and Low-Priced 1P Items (Red)

Amazon’s Q3 success highlighted strong performance in essentials and low-priced 1P items. This could indicate a strategic emphasis on maintaining its 1P model for staple goods, allowing the company to keep key products competitively priced and fulfill them efficiently.

Implication for Brands: Brands in categories outside of essentials might find Amazon shifting its 1P focus away from their products, prompting them to explore 3P opportunities or other e-commerce platforms.

The Strategic Considerations for Brands

- Monitor 1P Vendor Shifts: Brands should remain vigilant about changes in Amazon’s 1P selection, particularly if they rely on Amazon for a significant portion of their distribution.

- Evaluate 3P Opportunities: For brands not yet in the 3P space, now may be an opportune time to explore this route. The potential for greater control and reduced dependency on Amazon’s 1P distribution makes this a compelling option.

The Broader Impact on E-commerce

Amazon’s strategic decisions will shape not only its platform but also the broader e-commerce ecosystem. Whether through an accelerated shift to 3P, a focus on essentials, or a balanced approach, brands need to stay informed and adaptable. Understanding these potential moves will be key to maintaining competitiveness in an ever-evolving digital marketplace.

Fun Facts:

- Over 70% of third-party sellers on Amazon are SMBs, benefiting greatly from Amazon’s infrastructure.

- The share of units sold via third-party sellers has risen from below 50% in 2017 to over 60% today.

- Same-day delivery usage has seen a 25%+ increase, reinforcing Amazon’s logistics advantage.

Q&A: Addressing Common Questions

Q1: What are the main benefits for brands transitioning to a 3P model on Amazon?

Transitioning to a 3P model allows brands to have greater control over their pricing, branding, and customer engagement. This model can reduce dependency on Amazon’s 1P terms and offer higher profit margins by avoiding intermediary costs.

Q2: How should brands prepare for a potential 1P vendor purge?

Brands should develop contingency plans that include exploring 3P options and diversifying their sales channels outside of Amazon. Building relationships with other marketplaces and strengthening direct-to-consumer strategies can mitigate the risks associated with 1P vendor shifts.

Q3: Will Amazon’s focus on essentials impact other product categories?

Yes, if Amazon leans more heavily into essentials and low-priced 1P items, brands outside of these categories might see reduced 1P opportunities. This shift would encourage those brands to pivot to a 3P model or look for other sales channels.

Q4: What makes Amazon’s logistics capabilities significant for its 3P and 1P strategies?

Amazon’s advanced logistics network, highlighted by the 25%+ increase in same-day delivery usage, offers a competitive advantage. For 3P sellers, leveraging Amazon’s Fulfillment by Amazon (FBA) service can provide customers with faster delivery options, enhancing their shopping experience.

In conclusion, Amazon’s evolution will continue to challenge and shape the strategies of brands within its ecosystem. The future of 3P vs. 1P is a pivotal trend that brands must monitor and prepare for to harness the opportunities and mitigate the risks inherent in Amazon’s next moves.